The goal for any marketer is to focus on efficient and effective marketing campaigns that produce results. For outbound marketers, that means aggregating data well to...

Without reliable access to accurate data, marketing aims at the wrong targets, sales and marketing can’t be effectively aligned and revenue and ROI suffer, meaning it’s a problem you can’t work or spend your way out of. However, simply accessing accurate data is insufficient to reap the benefits of a truly data-driven marketing strategy. Even the best industry segmentation can't describe the business problem your product solves. And using just one or two criteria - industry and size, say, or business age and geographic location - still leaves a huge amount of work to do to achieve a highly targeted list that matches your marketing efforts with your ICP (Ideal Customer Profile). Let’s address data accuracy first.

Businesses typically draw their sales and marketing data from two sources: either they buy data from third parties, or they use their own data from CRM and marketing automation tools. Since it relates directly to sales, CRM data is usually the more valuable.

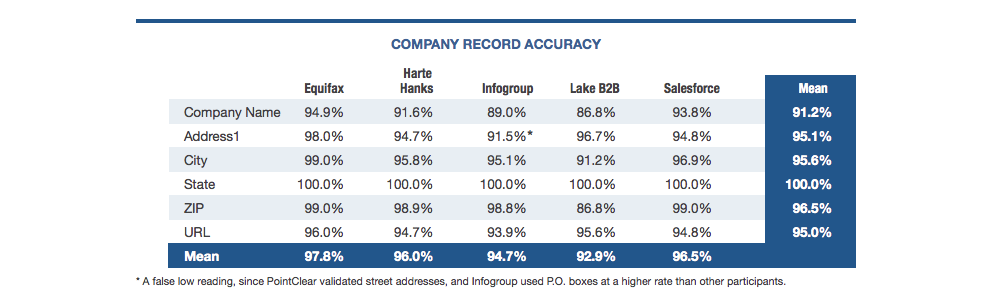

The data in bought lists is often of surprisingly good quality:

Typically you can be around 95% certain that any information you find in a bought list from one of the largest suppliers will be accurate.

However, it often doesn’t tell you a lot of what you need to know.

The typical bought list is accurate because it’s sparse. Company name, address, city, ZIP and URL is the beginning point of a targeted list, not the end.

Bought lists can get you into trouble with your email service provider too, and if you’re sending low-open, high-spam, non-opt-in messages you run the risk of your email service provider banning you to protect their own deliverability score and reputation.

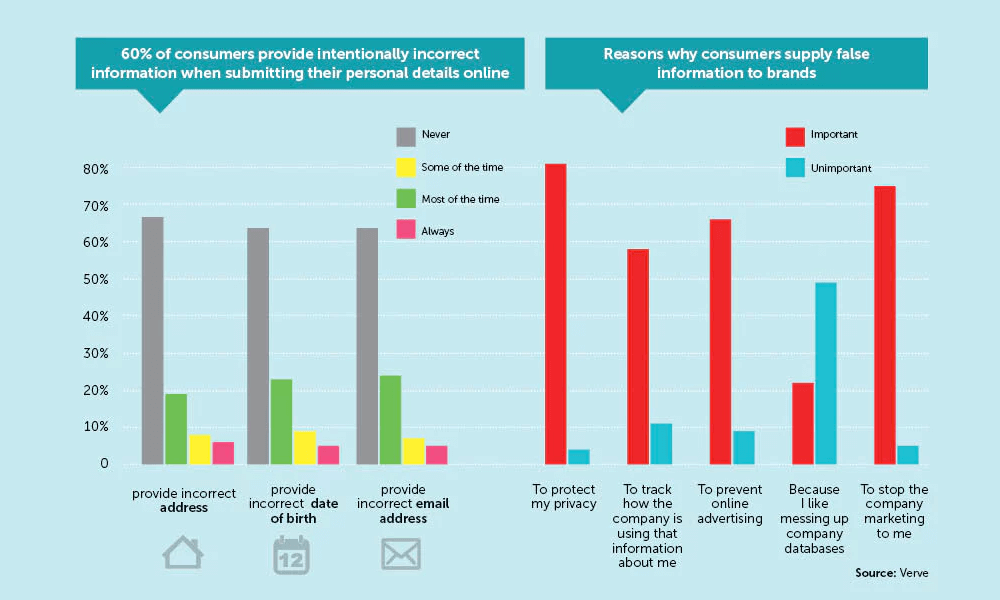

Finally, even data acquired by your own marketing department can be false right from the start. Take a look at this:

Over 20% of consumers said they gave false information to companies because the reason ‘I like messing up company databases’ was important to them. About one in twenty always lie about everything.

Granted, that’s consumers, and business customers likely behave differently; but without solid reasons to opt in you’ll often get a ‘zombie’ contact for a person whether they gave it up for an ebook on your site, or on the site of the company that sold you the list.

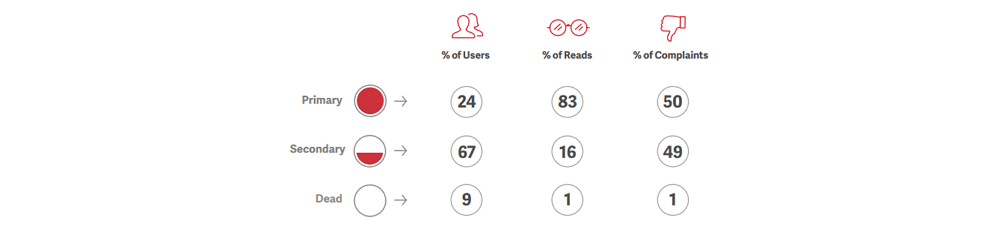

Nothing undermines a list's efficacy quicker. If most of the email addresses on your list are tertiary, dead or ‘zombie’ inboxes, your list is walking dead.

By contrast, CRM data is highly complete, often enriched - but far more unreliable.

Salesforce’s Adam Thorpe says about 70% of the data in CRM decays each year. OutboundWorks’ Ben Sardella says ‘over 50% of the data in most CRMs is out of date or invalid.’

It’s of great value for some purposes, including account based efforts and referrals, but it’s not where you’re going to find a lot of new business. The most effective solution is to buy lists, then check and enrich them yourself, or acquire your own lists via real opt-ins and signups. Most businesses will use a mixture of the two, and while acquiring your own data is less risky and expensive, fast-growing businesses rely on outbound to drive that growth.

Which brings us to: If you have to get your data from outside the company, how do you curate it to achieve a good fit and make it work for you?

It is almost impossible to pull a list by industry, size or other simple criteria and have it be 1-to-1 marketing ready. It needs to be both enriched and curated.

Source

That number’s closer to 6.8 than 5.4 now, but this point holds up. It’s true for marketing too - failure to develop accurately targeted, effective marketing campaigns that generate leads is more often because marketers are drowning in data they don’t know what to do with, than because of a paucity of data itself.

Time spent in review of the list for carefully defined criteria, such as what words on the customer’s website makes them a good fit, where they hang out online, or whether or not they have achieved certain financial milestones, can rapidly clarify which accounts and individuals are worth devoting effort to.

It’s here that the data in your CRM comes into its own, giving you the material to create an Ideal Customer Persona which you can then use as a filter to remove low-percentage or unsuitable accounts from the list.

This speaks to the process of enriching the list and winnowing it according to your ICP at the same time. Any account or individual that you can’t demonstrate business fit for should be dropped - chasing such accounts is unlikely to result in success, so you’ll do a lot of chasing with little reward.

It’s also important to know who are the decision makers and who are the decision makers’ main ‘supporting cast’ if that’s discoverable.

This knowledge, added to what you know about whether or not an account fits your ICP in other ways, tells you something about what the selling experience will be like.

If you’ve never managed to sell to a CIO, you’d downgrade accounts where the CIO is a chief decision maker, for instance. It can also help you identify early on accounts which might need more marketing than others. If your offering is priced by number of seats, say, then the selling process to enterprises will be very different than selling to a startup that wants ten seats, and that might buy in the first week based on minimal marcom and sales collateral.

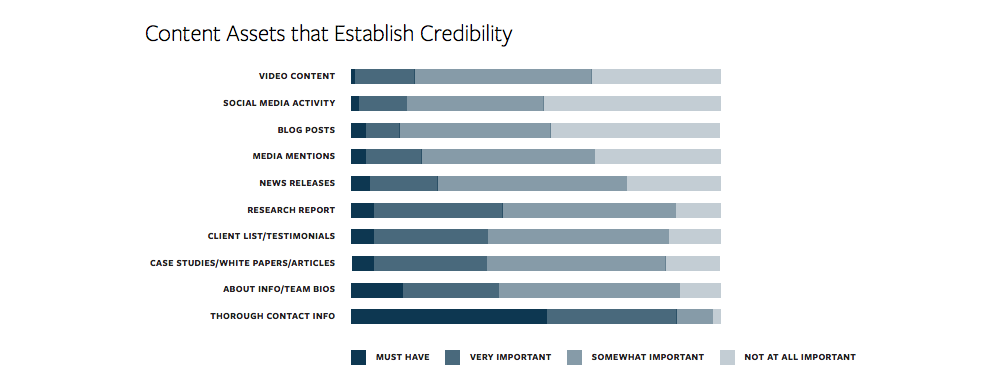

Enterprise clients that might want custom additions to the product, at a number of seats far in excess of anything in your normal price plan range, are going to take longer and require far greater amounts of information at every stage. They’re likely to want it in a different format too: older executives at more established organizations are more likely to want to read, reflected in the priorities shown here:

Younger leaders in startups might prefer video or more visuals-heavy communications, so startup founders and their teams might need not just different information, but different presentation.

Without curating the data that goes into your understanding of your audience it’s not possible to know this and plan marcom and collateral creation and distribution accordingly.

Having curated information also lets you target your messaging and communications better. Information about where the individuals you’ll be contacting spend their time online tells you something about how they’d like to be approached.

If the deal size makes it cost-effective, it’s possible to have your copywriters, marketing team or SDRs spend some time looking over those social media accounts to see how they communicate.

Matching tone and style is a big part of making your messaging effective, but doing it with individuals who will never become customers is a time and money sink; doing it from a bare-bones name-and-email list is impossible. Once again, lists have to be enriched and curated to be maximally effective.

When you have a list that has been curated to include well-matched, high-percentage leads, it’s worth considering what contact method you’re going to be using. If you’re primarily emailing, email address accuracy is paramount; if you’re doing a lot of calling, you may want to prioritize individuals with direct-dial phone numbers to increase the efficiency of your efforts.

Approaching your list in this way is the only way to ensure you’re not spamming your leads, you’re getting a high response rate and that translates into great meetings for your team and, ultimately, increased sales.

At each stage of the process, you’re looking for ways to make the list more efficient - to require fewer emails and calls per meeting.

Most businesses that buy data either get a sparse list in desperate need of enrichment before it’s of use to sales and marketing, or a much richer list that’s unreliable and inaccurate. So the problem of data accuracy needs to be solved first.

But on its own, it’s not enough. It’s table stakes for major players, which means it’s table stakes if you want to be a major player.

As well as being accessible, enriched and accurate, data needs to be carefully curated. Identifying common markers of high-value leads is just the start. With a list curated to match product, messaging, and audience, you’re ready to extract maximum value from your efforts; without it, you’re likely to wind up spraying and praying at ever-increasing volumes, so ROI never rises.

The goal for any marketer is to focus on efficient and effective marketing campaigns that produce results. For outbound marketers, that means aggregating data well to...

In theory, Facebook is a fantastic platform for creating or transferring custom audiences. The wealth of data Facebook holds on users, and the many options for defining...